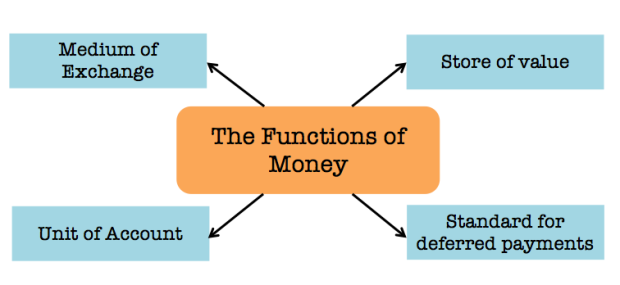

There are several different functions of money in an economy including medium of exchange, store value, unit of account and standard for deferred payments

Medium of Exchange

- The main purpose of money is for it to be a medium of exchange so that it can be exchanged for goods and services between buyers and sellers when they trade.

- Although, when hyperinflation occurs, inflation will increase at a incredibly rapid rate (possibly rising at some hundred or thousand percent annually) and it may result in money becoming useless/worthless. Due to money becoming worthless, it may no longer be an ideal medium of exchange and people may prefer to use gold, food or other commodities s a medium of exchange.

Store of value

- Money can be saved and retrieved or used at a later time. This encourages people to save as money saved now can be used in the future.

- However, money is not an ideal store of value when inflation is high. If interest rates are higher than the rate of inflation, this can run down the value and worth of a person’s savings.

Unit of Account

- Money is a unit of measure for the value of goods and services in an economy. The value/worth of different goods and services can be compared in relation to money. Transactions are recorded in monetary terms.

- Monetary value be distorted and as a result, utilizing money as a unit of account can be an issue as people may become unsure about the correct value of money.

Standard for deferred payments

- Some goods can be payed for at a later date and this is called a deferred payment. An example of a deferred payment is a debt and a “standard of deferred payment” is a way of settling a debt. This means that the seller is able and willing to accept payment in the form of money in the future.

- As mentioned in Introduction to Inflation, inflation helps borrowers and those in debt as their wages and incomes will increase but their debt would remain the same. They will pay back money that will buy less than it did when they borrowed. “Over time, the amount repaid has less purchasing power than the amount borrowed”