KS3 Recall that there are 3 states of matter; gas, liquid and solid

1.1 Understand the arrangement, movement and energy of the particles in each of the states of matter

The 3 states of matter are SOLIDS, GASES and LIQUIDS.

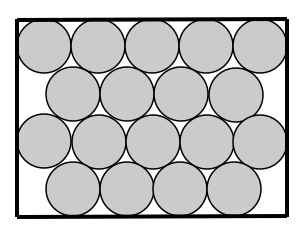

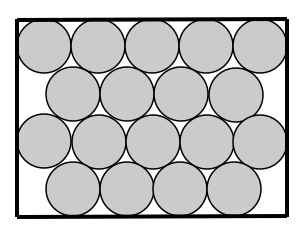

SOLIDS

How are particles arranged in a solid? Solid particles are held closely in fixed positions and have a regular arrangement.

How are the particles attached to each other? Solid particles are very tightly attached together through bonds.

How do the particles move? Solid particles vibrate in fixed positions

The kinetic energy of solid particles is the lowest of all 3 states of matter

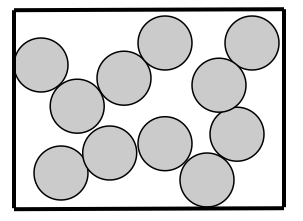

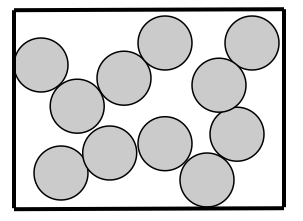

LIQUIDS

How are particles arranged in a liquid? Liquid particles are held close but can move around and past each other but do stay together. They have a random arrangement.

How are the particles attached to each other?Liquid particles are attached together but move more freely than solid particles but they are bonded together more so than gas particles.

How do particles move? Liquid particles are close together but can flow freely.

The kinetic energy of liquid particles is higher than that of solids but lower than that of gas particles.

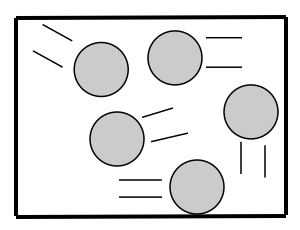

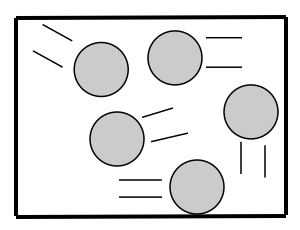

GASES

How are the particles arranged in a gas? Gas particles are farther apart and aren’t bonded together. They have a random arrangement.

How are the particles attached to each other? Gas particles aren’t attached to each other.

How do the particles move? Gas particles have total freedom and move in all directions.

The kinetic energy of gas particles is the highest of all 3 states of matter.